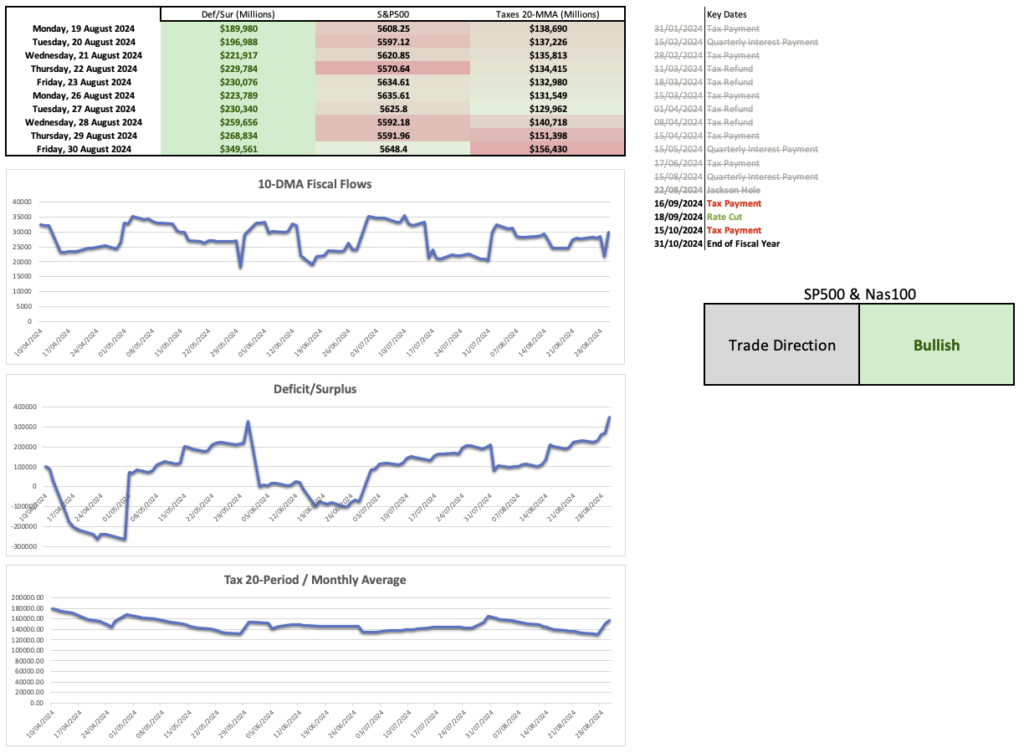

As of now, I only have access to data through the last trading day of August, creating a lag between the most recent market movements and the year-to-date trends. However, what transpired in August is worth highlighting. To put it plainly, the market’s fundamental developments were extraordinary.

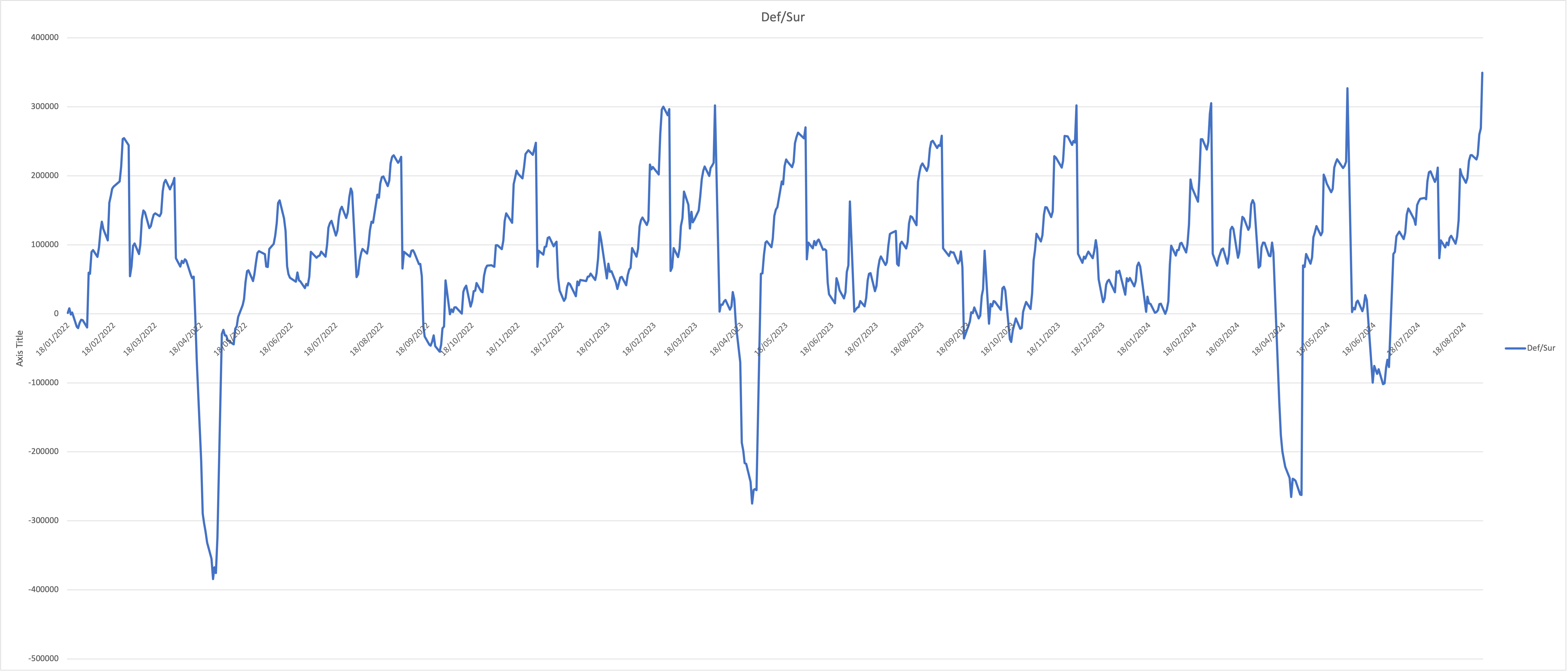

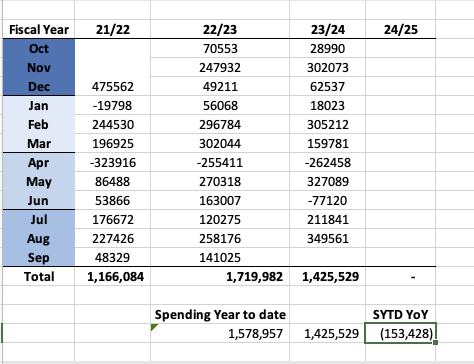

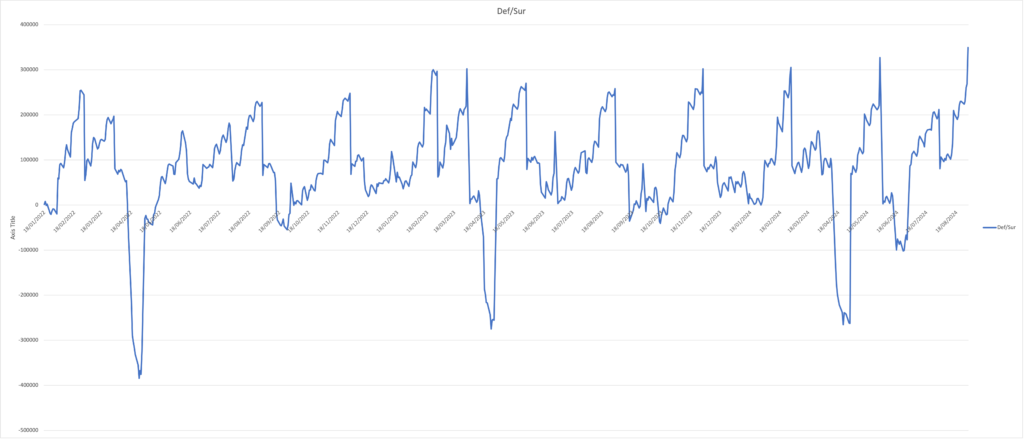

The fiscal dynamics were particularly noteworthy. Due to September’s first-of-the-month payments being pulled forward, we witnessed the largest monthly disbursements since I began tracking this data. This anomaly in government spending may have contributed significantly to the market volatility observed yesterday, which I attribute to the anticipation of key events later this week. It should also be noted that y-o-y we are still seeing a drop in the deficit. Even though the leading flows are very strong. Taxation is not particularly high as compared to 2022 but this could change in the coming weeks and until the end of the fiscal year.

It’s important to remember that Non-Farm Payroll (NFP) week is notoriously challenging for traders and investors. Market fluctuations during this period often seem designed to shake participants out of positions. This volatility is compounded by the Federal Reserve’s shifting focus from price stability to employment metrics. Despite these challenges, the U.S. labor market remains robust, evidenced by historically low benefit payments—a clear indicator of a healthy employment environment.

Given these factors, I remain vigilant, waiting for a clear signal to pivot from a bullish to a bearish stance. Until such a signal emerges, I am exercising patience, awaiting a technical setup that aligns with the underlying fundamentals.

In reviewing this morning’s briefings from major financial institutions, a few key points stand out. Goldman Sachs has begun advising clients that the Federal Reserve is “behind the curve,” while ING has cautioned that markets “may need to become more concerned about a U.S. recession.” This constant flip-flopping in sentiment—where one day Fed easing is deemed beneficial for equities, and the next it’s seen as detrimental—raises questions about the validity of such analysis. If the impact of Fed policy were clear, it should logically be either good or bad for the markets, not both.