The U.S. September quarterly corporate tax drain has commenced, putting additional pressure on market liquidity and fiscal dynamics.

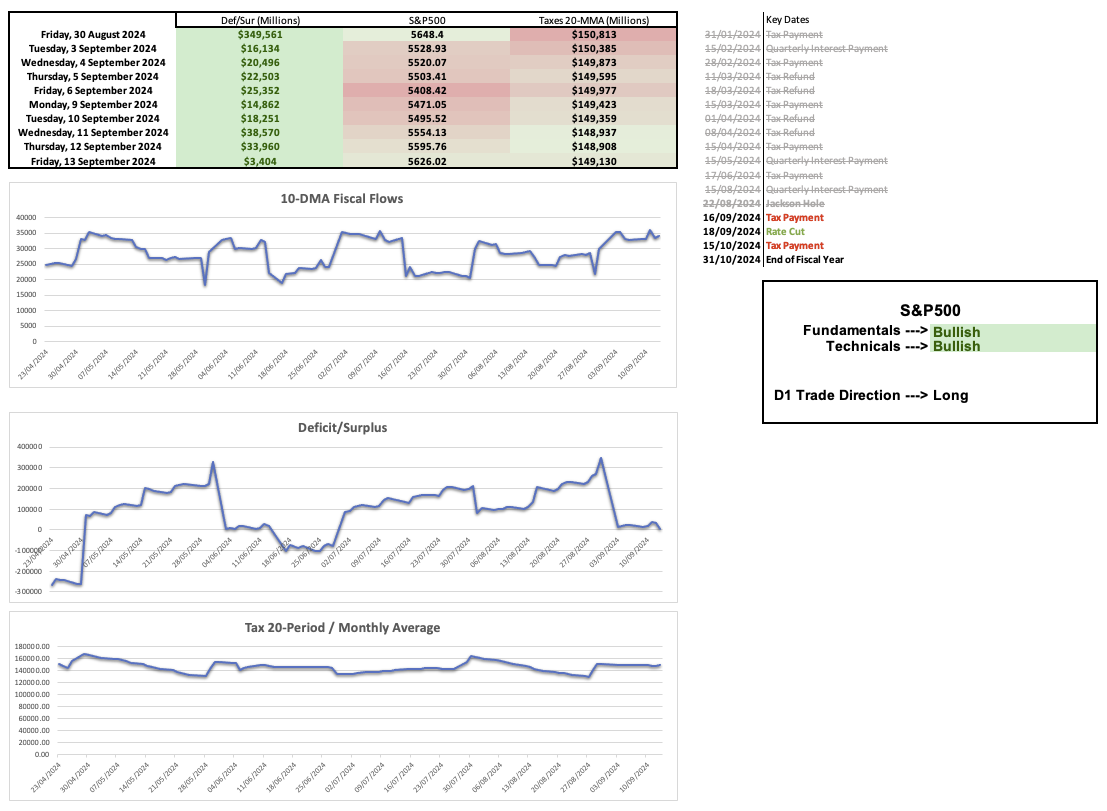

As of last Friday, deficit spending contracted sharply to just $3 billion, a significant reduction from the staggering $350 billion in late August. While there is still a technical case to be made for staying long on the S&P 500, any further net liquidity drain could threaten stop-loss levels.

Looking ahead, a 50 bps rate cut remains on the table, with a 67% probability of action tomorrow. Such a move would accelerate the reduction of interest payment transfers and compress overall government spending. While some market participants may celebrate the Fed’s easing stance, this enthusiasm is short-sighted, akin to “turkeys cheering for Christmas.” Yes, we may witness a brief bullish surge following the rate cut announcement, but as the economic outlook deteriorates and all else remains constant, equity markets are likely to reverse course.

The prospect of averting this downturn hinges on increased fiscal expenditure, particularly under a new administration willing to invest in critical infrastructure and technology. What we must avoid is austerity rhetoric or the pursuit of a “balanced budget,” which could exacerbate economic challenges. Core spending drivers such as Social Security, Medicare, Medicaid, and Defense will continue to anchor the budget near $7 trillion. However, lower “Cost of Living Adjustments” (COLA) for the fiscal year—following the 3.2% increase for 2024—could constrain spending growth.

The upcoming COLA adjustment in October will reflect the effects of reduced inflation, and with fewer interest payment transfers and diminished Social Security adjustments, we could see U.S. real GDP growth fall by 1-2 percentage points, bringing it dangerously close to 0%.

Tread carefully, and be cautious of what you wish for.

If the market (US500) is looking for liquidity to sell into, they will find some at this market structure high, or above the all-time highs. My Darwinex strat is nearing a 4% gain, which could be wiped out on market volatility. I have my SL set to BE + costs. Unfortunately, there isn’t much more to do other than take some profits and let the rest run.

- The difference between trying to show investors that you can manage risk versus showing us that you can pick some winning directions is massive. WIth the 125 Trade Challenge all you need to do is pick the correct direction and hit TP. The money side of things is just happening in the background. It is of no concern. If you follow the process and can trade, the money will come. With the Darwinex strategy, I am trying to show that trading less, and only your A++ setups, and incorporating good risk management you can attract money from other investors.

- They just want to see that you’re not losing their money.

- If you can beat the returns of the S&P500 benchmark, and inflation, they’re not worried about massive returns. Just consistency.