Looking ahead to the 2025–2029 period, there’s genuine excitement around potential shifts in U.S. fiscal policy and the corresponding effects on market behavior.

Notably, the newly proposed Department of Government Efficiency will have a mandate to reduce federal spending by an ambitious $2 trillion. This move, if enacted, could significantly reshape the economic landscape, impacting everything from government programs to market liquidity.

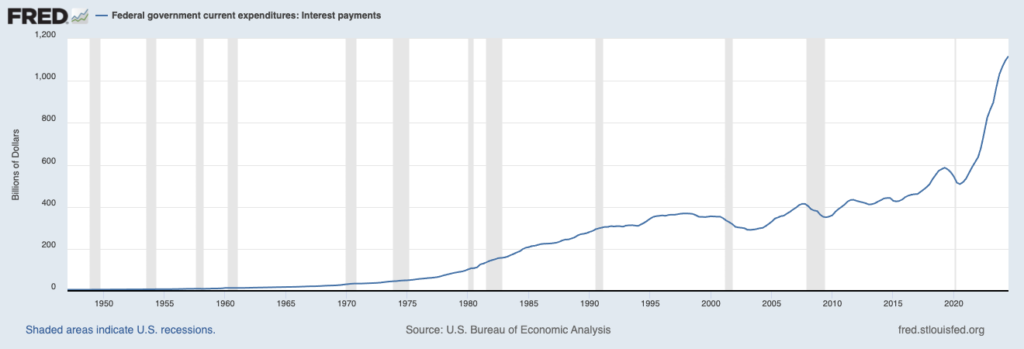

To stir further thought, I propose a bold suggestion for Elon Musk: eliminate interest payments on U.S. Treasury securities, which could immediately free up approximately $1 trillion. Wealthy individuals and institutions who invest in Treasuries could arguably forgo this return in the national interest, fostering fiscal prudence without placing additional strain on average taxpayers.

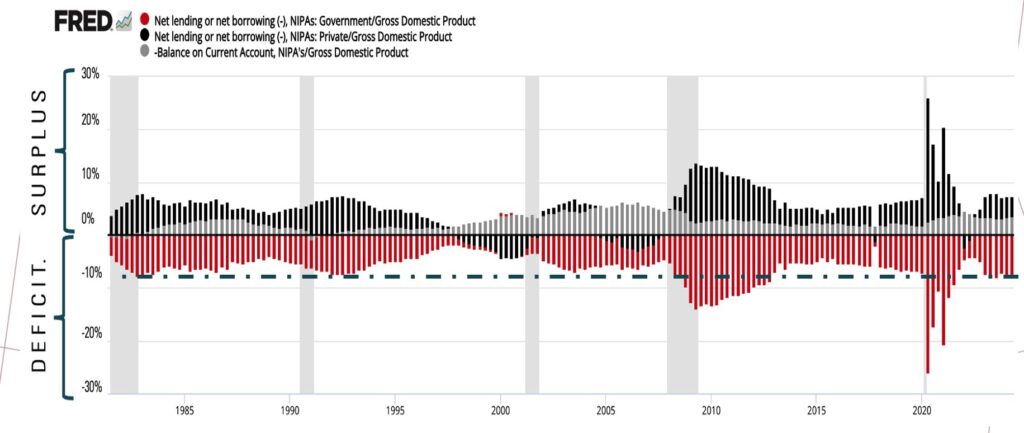

Yet, as we’ve seen in recent years, increased government spending has reliably spurred GDP growth, while tax hikes have dampened market sentiment, often cooling investor enthusiasm. The delicate balance of these forces will undoubtedly shape the trajectory of U.S. growth and stock market performance.

If you share my interest in understanding how these shifts in fiscal policy will influence the markets, follow my blog, where I’ll continue exploring these developments in depth. We’re on the brink of a fascinating period—stay tuned as I examine each step of this journey and its implications for investors and policymakers alike.